What we do

- RECOVERY OF SOCIAL SECURITY CREDITS

Essentially, any area of a company can be outsourced. It is necessary to evaluate the need to outsource certain areas in order to generate benefits for the business. With our client portfolio and market knowledge, we can help you define what’s best for your company!

- eSOCIAL LABOR PROCEEDINGS

- LABOR PROCESSES AT eSOCIAL

With the requirement to submit labor process events to eSocial, our Labor and Payroll team is well-equipped to fulfill the demands of transmitting these events wit agility and expertise. We provide labor advisory services, conduct thorough mapping, and offer support in sourcing the requisite information for event submission. Our services also include batch transmission of information to eSocial, thorough review of inconsistencies, and the development of a streamlined process manual, complete with step-by-step guidance. Our objective is to ensure the seamless and continuous delivery of events by the company.

- Impugnment the FAP

The Accident Prevention Factor (FAP) is a multiplier calculated by CNPJ (corporate tax payer ID) that directly affects the value of taxes on payroll according to the degree of accidentality in the company. Annually, in September, the Revenue publishes a new FAP index for companies, which can directly impact the cost of payroll. We have a specialized team to analyze the published index and, depending on the factors used to increase the index, present an administrative challenge on behalf of the company.

- OTHER SERVICES

- Payroll reviews for compliance and opportunities.

- Designing and redesigning processes in the personnel department and human resources sectors.

- Evaluation of variable remuneration structure.

- Analysis and application of the Social Security Calculation on Gross Revenue.

- Risk and contingency assessments in Labor and Payroll;

- Development and review of HR policies.

- Payroll recovery.

Credits

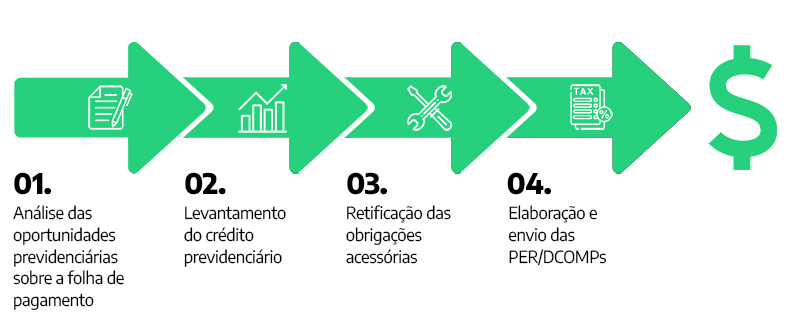

In recent years, there have been changes in the understanding of the Social Security computation basis, along with new stances from the Federal Revenue Service and definitive rulings from higher courts.

Our approach consists of a complete review of all the Social Security calculations for the last 60 months to identify any untapped opportunities for your company.

Specialist Partners